TradeSecure For Corporate Treasury

6 Reasons Why Digital Working Capital Solutions Matter:

- Enhance bottom-line profitability through working capital finance

- Ensure valued suppliers are paid on time, securing and strengthening your entire supply chain

- Increase availability of liquidity & working capital

- Enhance and deepen your banking relationships

- Increase security and reduce fraud exposure

- Current invoice finance solutions are sub-optimal, siloed, and have limited reach.

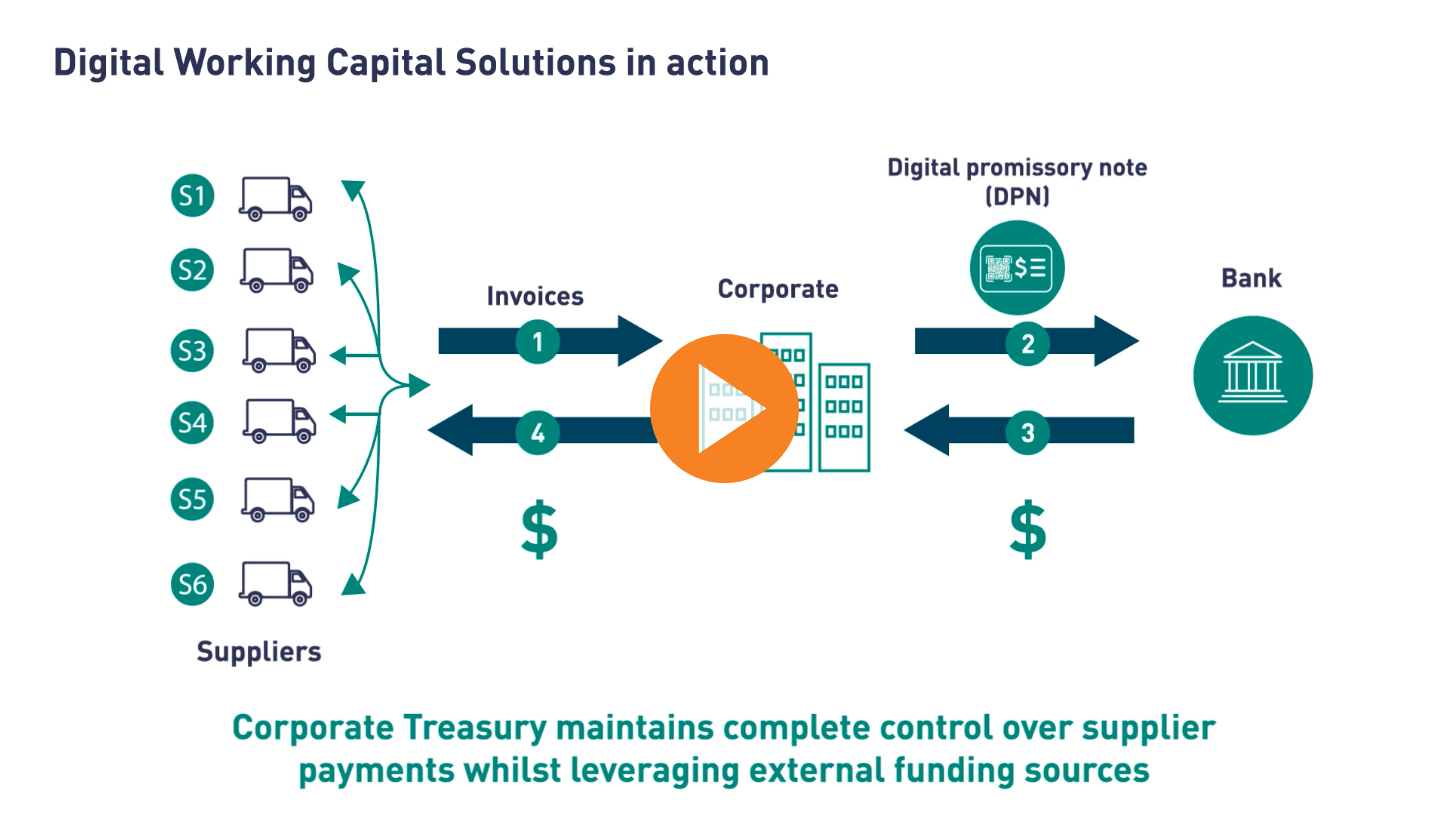

For corporate treasurers looking to improve their working capital and earnings and make operational cost savings without disrupting their terms of trade, digital promissory notes are fast becoming part of forward-looking treasurers’ toolkits.

Find out how much trapped liquidity you could release – try our free cash conversion cycle calculator:

TradeSecure SCF 2.0

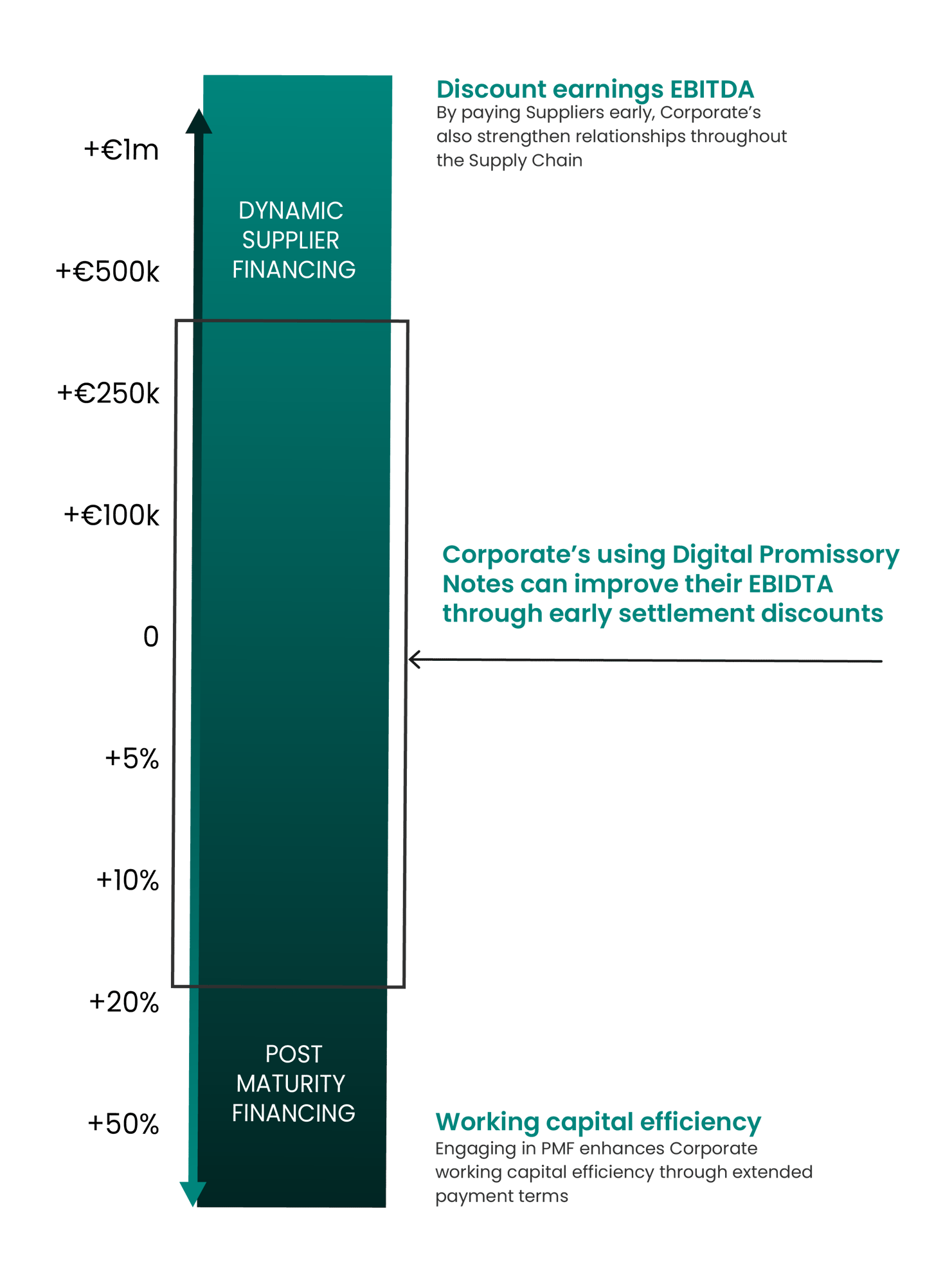

- Corporate Treasurers target (EBITDA) and working capital optimisation, targets that traditionally conflict.

- TradeSecure generates Digital Promissory Notes to underpin additional funding to achieve supplier settlement discounts, EBITDA benefits and increased working capital efficiency.

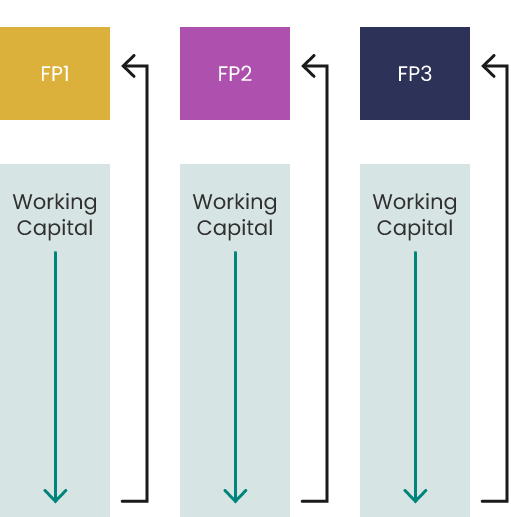

- Using Digital Promissory Notes, a Corporate has the strategic flexibility to manage trade creditors & bank debt via an ERP system. Corporates can:

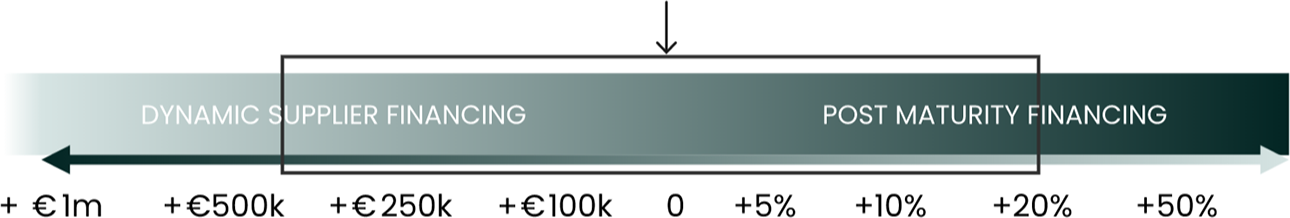

- Get full flexibility to use Dynamic Supplier Financing (e.g. Dynamic Discounting) and Post Maturity Financing (PMF) individually or in combination

- Draw on their own or external liquidity as the liquidity situation changes over time

- Generate additional earnings (EBITDA effect) and at the same time improve working capital ratios, (cash conversion period) gain further leeway to extend payables days without renegotiating Supplier terms & improving Supplier liquidity

Additional benefits from using TradeSecure’s Digital Promissory Notes

- Auditable history of all transactions from invoice approval through to repayment of any financing

- Infinitely scalable solution with many more potential use cases

- Low and fully transparent solution costs

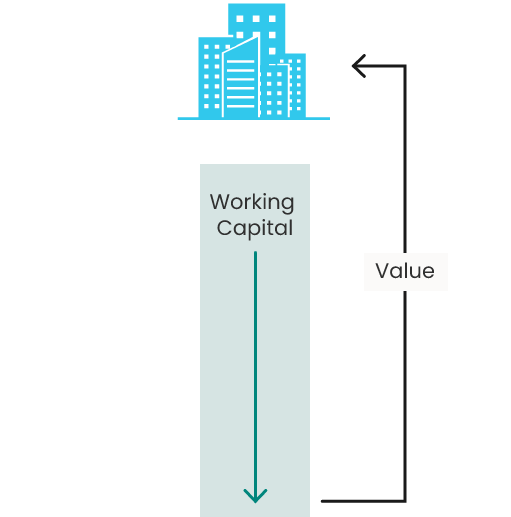

Corporates using Digital Promissory Notes can improve their EBIDTA through early settlement discounts

Discount earnings EBITDA

By paying Suppliers early, Corporates also strengthen relationships throughout the Supply Chain

Working capital efficiency

Engaging in PMF enhances Corporate working capital efficiency through extended payment terms

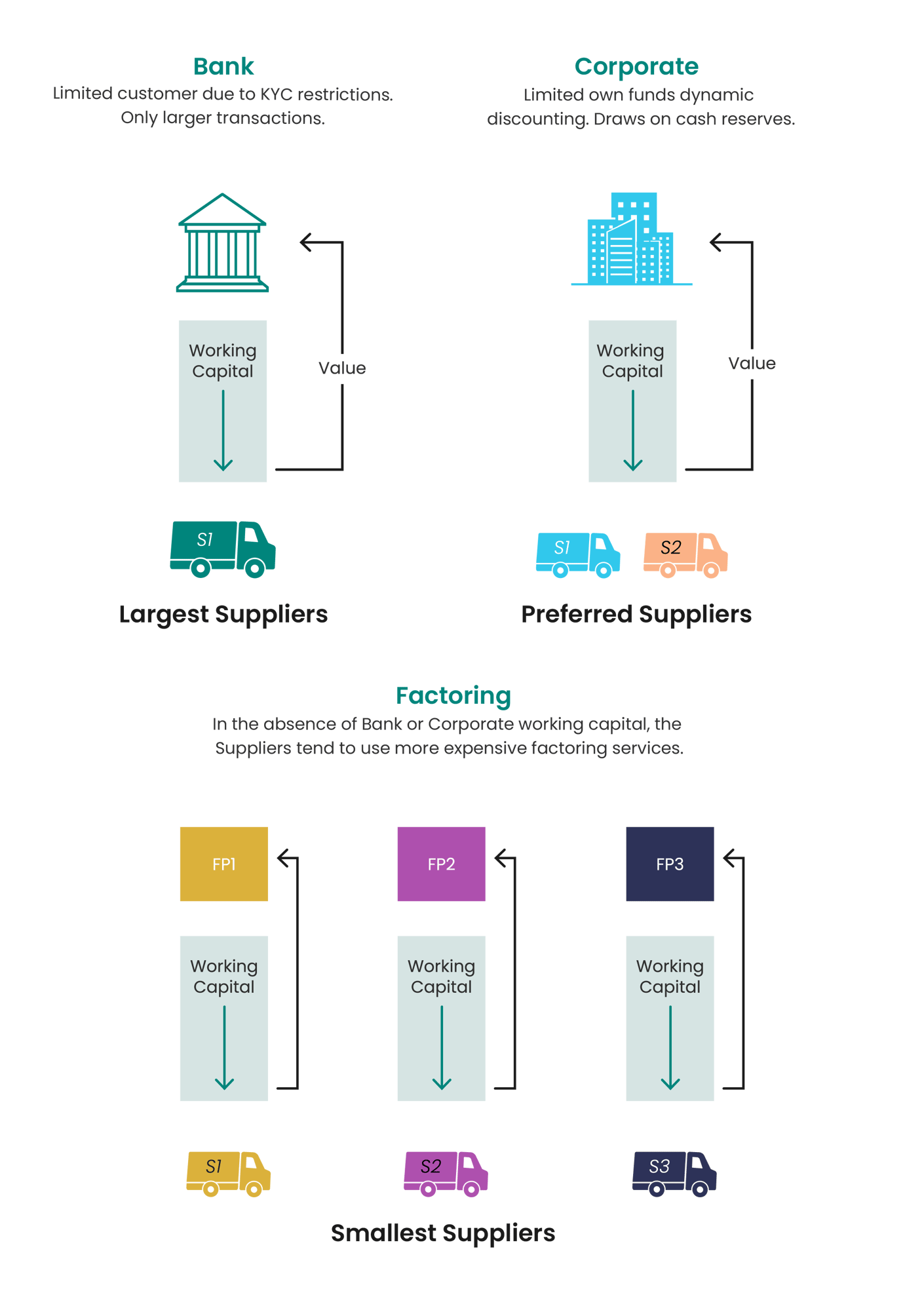

Current Invoice Finance –

A fractured, insecure & inefficient process

Bank

Limited customers due to KYC restrictions. Only larger transactions.

Largest Suppliers

Corporate

Limited own funds dynamic discounting. Draws on cash reserves.

Preferred Suppliers

Factoring

In the absence of Bank or Corporate working capital, the Suppliers tend to use more expensive factoring services.

Smallest Suppliers

Legislation Enables Digital Advantage: Securing Your Business And Unlocking Financial Benefits

- Ensure Supply Chain Finance benefits your bottom line.

- Ensure banks finance 100% of invoice value.

- New Digital solutions allow you to finance more suppliers, using a wider range of banks/investors. They eliminate the need for banks to perform onerous onboarding and KYC of suppliers.

- Lower costs for your suppliers than using banks or factoring firms, enhancing control and strengthening your supplier relationships.

- Financing from banks against new digital solutions may be beneficial for balance sheet ratios & debt covenants.

- Deploy your cash reserves for other projects that yield a better return.

Digital Treasury Solution Advantages

Incumbent Processes

- Late payment to suppliers can weaken Supply Chains

- Standard digital processes and paper instruments lead to fractured and siloed funding decisions

- Lower Liquidity – inefficient & poor transferability

- Operating large SCF reverse factoring programmes includes significant third-party software costs and administrative burdens for Banks

- Large Ticket, Low Volume. Low Transactional Flow

- Traditional invoice payment does not guarantee that 100% of the Invoices are financed

- Paper processes are not compliant with ESG standards

- For paper -Inefficient with lengthy creation & processing time e.g. Post, Couriers, Cross-border processing, Tracking

- Narrow silo dynamic discounting programme -High Transaction Threshold –only used for larger transactions

- Bank cost of onboarding a corporate or corporate supplier = $60k, and will only onboard large customers. Only covers 20% of Supply Chain

- Not Secure –Bank fraud totalling over $9 bn in past 5 years

New Digital Processes

- Dynamic Discounting programmes ensure suppliers are paid on time or earlier at a discounted rate

- New Digital solution concentrates control & flow creating a stable and secure supply chain, strengthening relationships throughout

- Higher Liquidity – faster & more dynamic transfer

- New Digital solutions remove these operational burdens allowing second and third-tier banks to engage in SCF programmes which is further beneficial to corporates and their suppliers

- Small and Large Ticket, Increased Volume. High Transactional Flow

- New Digital Promissory Notes and Digital Bills of Exchange are simple to use and guarantee that 100% of the invoices are financed in full by the Bank/Investor

- More sustainable with significant ESG upside

- Transaction processing time significantly reduced and end-to-end transaction costs are cut by up to 80%

- Simple dynamic discounting across the entire supply chain - Any size, open to MEs, SMEs - Ability to extend existing SCF programmes to those who are not currently eligible

- The dynamic nature of these digital solutions reduces KYC checks for Banks to 1 Corporate Buyer for the benefit of MEs & SMEs

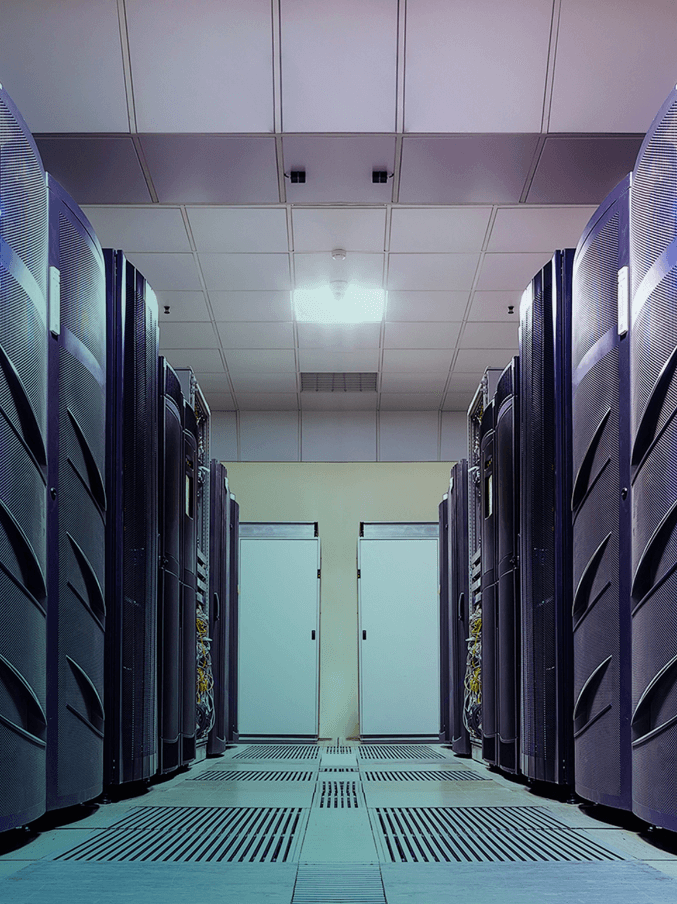

- Quantum Safe & Futureproof. (Cannot be forged, copied, altered or lost)

Get Started with Arqit TradeSecure

The process to access the benefits of Digital Working Capital is dynamic, low cost and system agnostic:

- Direct integration into digital trade platforms enabling Straight-Through-Processing (STP)

- For corporates who don’t use digital trade platforms it is as straightforward as uploading invoice data using CSV files

- Swift and Simple deployment