TradeSecure For Banks

.png)

Sullivan & Worcester Advises Arqit on Documentary Framework to Support the Issue of Electronic Promissory Notes under the Electronic Trade Documents Act 2023

Why Banks Need Future-Proof Trade Finance Technology

Digital Negotiable Instruments such as Digital Promissory Notes and Digital Bills of Exchange are increasingly being used in working capital solutions, with buyer-led supply chain finance programmes expected to double within the next 5 years. With legislation based on the UN’s MLETR being adopted around the world, these instruments represent the future of trade finance.

Banks need to ensure digital documents can be trusted from invoice origination through to acceptance, and potentially onward endorsement, of the finance instrument.

Arqit TradeSecure is a quantum-safe independent minting and sealing service for DNI. offering full traceability and visibility of instruments, maintained by a cryptographically immutable “digital twin” that records changes of ownership in a secure digital ledger.

Arqit integrates its SKA Platform™ and Digital Negotiable Instrument (DNI) solutions, which meet the legal requirements set out in the UK’s Electronic Trade Documents Act 2023.

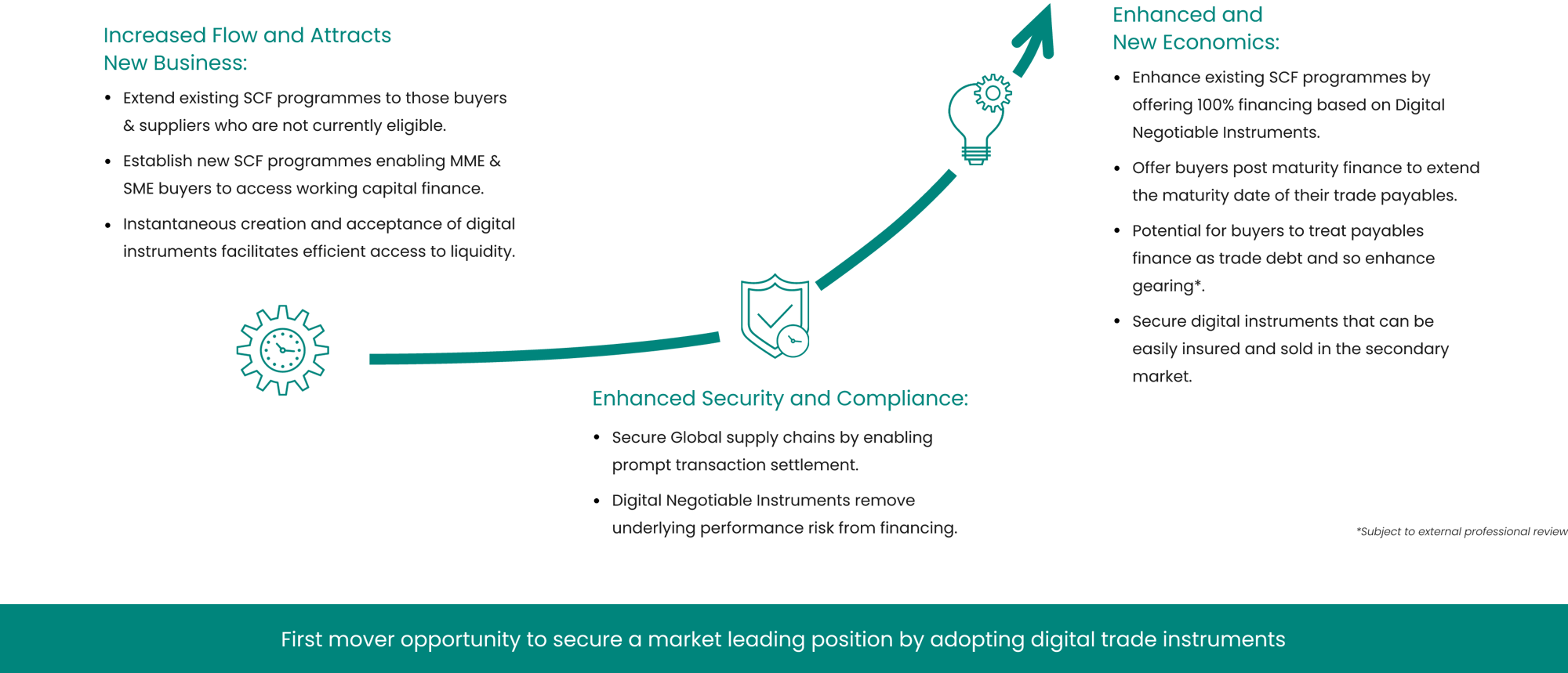

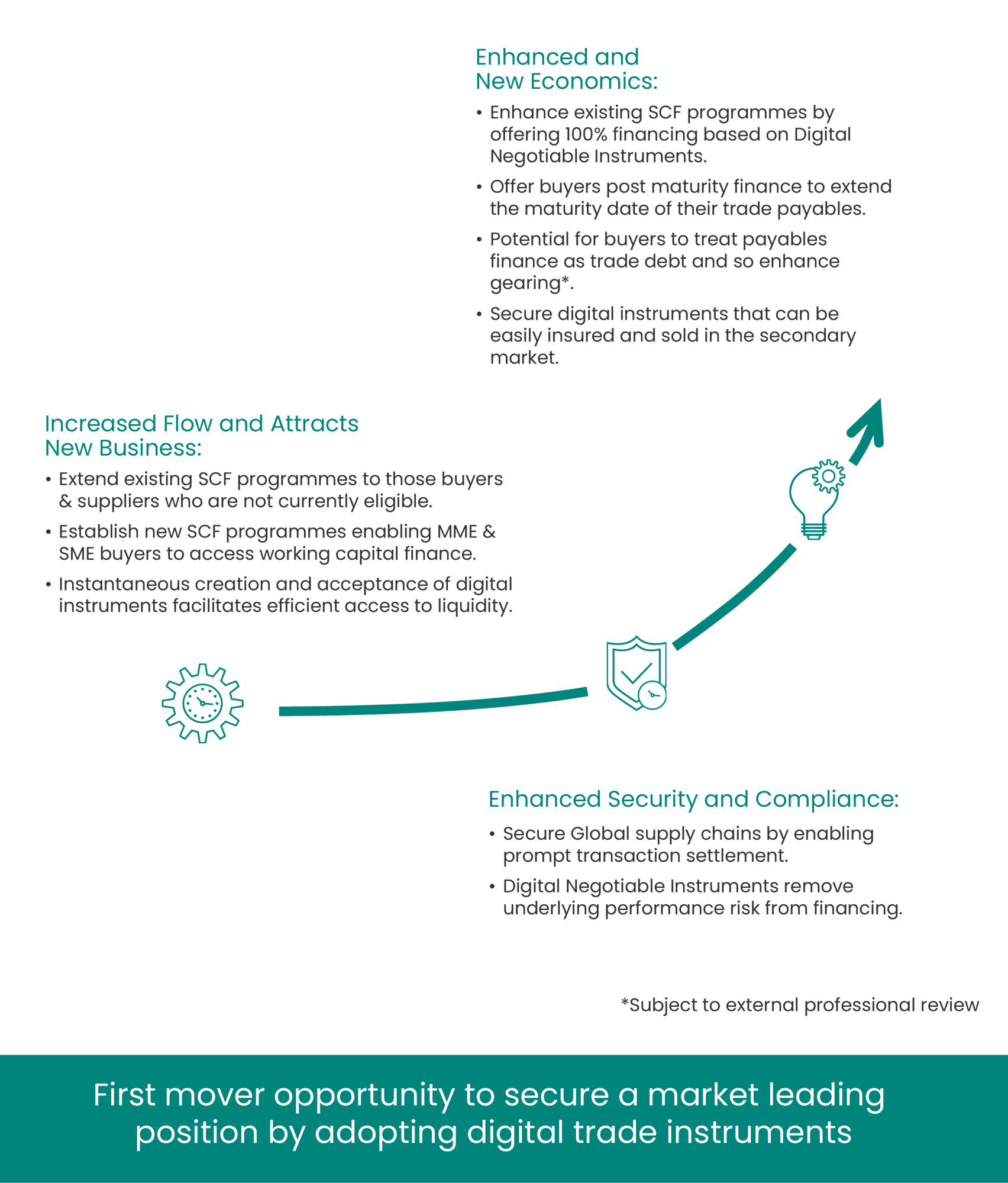

The Benefits Of Digital Trade Instruments

Remove paper-based processes

The end of reliance on document couriers streamlines the entire supply chain, benefitting all parties and providing faster, more efficient access to liquidity.

Reduce compliance burdens

A single point of access, the ability to manage all instruments issued and currently active, and provision of dynamic discounting significantly reduce required compliance measures.

Quantum-safe

The quantum secure nature of TradeSecure Digital Trade Instruments and the immutability of the digital ledger reduce both credit and fraud risk.

Follows existing finance processes

You can implement TradeSecure seamlessly into your existing business processes as it mirrors familiar paper-based systems, but with enhanced outcomes.

New Supply Chain Finance Opportunities in The Digital Age

Enhance your customer acquisition and retention through use of simple & secure digital trade instruments.

Fully auditable transaction flow

is key to a reliable system

Banks and Investors using Digital Negotiable Instruments (DNIs) need to be able to rely on the integrity of the system and of the data used to generate the DNIs. We ensure that the transaction process is traceable and auditable from end to end.

How and why does TradeSecure make its technology fully auditable?

1

Data at source is accurate & reliable: In order for a DNI to be legally relied upon, the data in the Instrument has to be fully verifiable. This is why TradeSecure draws upon data from source, rather than securing drafted documents. Documents themselves cannot reveal the source and accuracy of data contained within them, which can be compromised by poor machine reading, errors and fraud. TradeSecure enables a complete audit trail of all the data points from invoice origination to retirement of the instrument. TradeSecure “mints” a digital Instrument only when it has collated the relevant invoice data straight from source, using an API connection with a Corporate's ERP system. This data will then be used by TradeSecure in the ‘minting process’ in which the invoice data is uploaded via a quantum-safe connection.

2

Proof of authenticity is key to a valid DNI:Leveraging Arqit's patented symmetric key encryption, Corporate signatures are uploaded onto TradeSecure by authorised signatories. When a minting request is made, electronic signature images are embedded into the immutable minted Instrument providing a proof of the Instrument’s authenticity, as both the Corporate and the individual signing on behalf of the Corporate are identifiable.

3

Instrument's unique identification is essential for traceability: Every DNI has a unique immutable ID. The ID generated by Arqit’s technology cannot be altered, which allows the instrument to be secured and traced through its transaction journey on the TradeSecure Gateway. When an Investor wishes to take possession of the DNI, they can scan the Instrument's QR code to confirm the authenticity and ownership of the document on quantum-safe blockchain, including the underlying invoice data attained directly from the corporate ERP. If an unauthorised third party attempts to change the content of a DNI it will generate a new ID, which would invalidate the altered Instrument thereby protecting the original as the blockchain validation audit would reject the changed DNI.

How does this audit capability help a Bank / Investor to rely on a Minted DNI ?

1

Transaction Audit: It is essential that a Bank/Investor intending to finance a DNI can view the source invoice data prior to accepting the DNI, and can trace the data flow back to source when it is duly retired. Any Bank/Investor always has the ability to cross-reference the authenticity of the DNI against a ‘Digital Twin’ stored on the TradeSecure blockchain (created at the time of minting) which provides a full record of the transaction.

2

Legal Audit: Adoption of DNIs is dependent on their ease of use and on their legal recognition as they may be used in evidence. TradeSecure has created an easy-to-use, legally recognised digital instrument, that meets the ‘Gateway Criteria’ and legal tests set out in the UK’s 2023 Electronic Trade Documents Act. Any dispute as to the provenance of the DNI can be traced throughout the transaction history back to the source data of both the invoice data and the signatures. Arqit’s Military grade-security coupled with complete visibility of transaction data throughout the instrument’s life cycle means that TradeSecure can guarantee that the DNI is 100% genuine and unadulterated throughout its lifecycle and therefore can be legally relied upon.

3

Accountancy Audit: TradeSecure DNIs contain all the necessary data for a Corporate to operate under both IFRS and Local GAAP accounting standards, by providing a full audit trail of the contents of a DNI, including the underlying invoices and the associated corporate actions.

Quantum-Secure By Design & Specific To Global Trade

Arqit TradeSecure is a digitally native service that mints and secures trade finance assets and leverages Arqit’s quantum-safe patented technology to future proof supply chain finance solutions against cyber-attack, transaction disruption and fraud.

By securing digital trade documents to the highest standard financial institutions, banks, corporates and SCF platforms can fully rely on the integrity of their trade documents now and in the future.

A new way to mint & Distribute Negotiable Instruments

DNIs SECURED BY SYMMETRIC KEY AGREEMENT ARE QUANTUM-SAFE

- Allows the Digital Negotiable Instrument to be unique

- Register can be used to verify legitimacy and legal owner

- Meets the Seven Gateway Criteria the Law Commission have set

ARQIT TRADESECURE - TRANSFORMATIONAL INNOVATION

- First-of-kind Quantum Safe solution for Digital Negotiable Instruments (DNI)

- Implements Quantum-Safe Security to the Trade Finance Ecosystem

SIMPLE TO IMPLEMENT

- By separating the security layer from the distribution tier we gain agility and control

- Two points of command & control: the DNI & the DNI Ledger

SUITABLE FOR HYPER SCALE

- Software, fulfilled from the cloud, automatically creates DNIs in infinite volumes at minimal cost

- Solves the problem for Buyers, Sellers and Investors across the world

.png)

The need to secure your Supply Chain Finance programmes

The paper-based processes used by current supply chain financing programmes are slow and at risk of fraud. Bloomberg estimates that between 2014 and 2020, the losses to banks from trade finance defaults linked to fraud totalled $9.26 billion (£7.67 billion).

Securing trade documents “now and into the future” is the key to an efficient and profitable trade finance programme.

TradeSecure delivers these capabilities.

Be at the forefront of trade finance

Inefficient paper-based instruments are being replaced with Digital Negotiable Instruments: their global adoption is underway - improving liquidity, lowering risk and reducing cost.

More efficient supply chain financing

New SCF programmes make it easier for companies to access their capital and financial assets. The instantaneous creation and acceptance of digital instruments improves cash flow, helping businesses of all sizes.

Meet the increased demand

TradeSecure has been developed to meet the needs of the UN’s Model Law on Electronic Transferable Records (MLETR), and is fully compliant with new MLETR-based legislation. Our service allows users to benefit from new legislation that permits the use of digital trade documents.

Traditional security is under threat

Arqit protects you against disruption and fraud, and offers you quantum-safe cybersecurity, protecting you and your business from both current and future cyber threats.